Are you ready for the Investment Firms Prudential Regime (IFPR)? – Part Two

Matched principal trading

There is no matched principal exemption under the Investment Firms Prudential Regime (IFPR) IFPR, so €50,000 matched principal brokers will move to a PMR of £750,000 (over five years). While there is no longer the benefit of a lower capital requirement, the FCA believes it is helpful for such firms to ‘limit’ their activity of dealing in investments as principal, in order to clarify how they trade and to demonstrate they are a lower risk principal dealer.

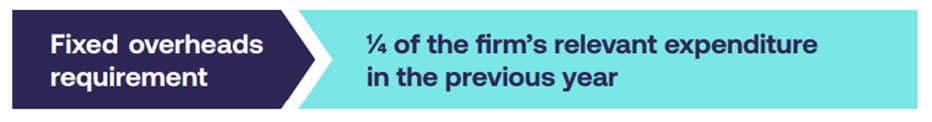

The FOR is intended to calculate a minimum amount of capital that an investment firm would need to have available to absorb losses if it has cause to wind-down or exit the market.

To calculate relevant expenditure for the purposes of FOR, the investment firm first determines its total expenditure aer it has made any distribution of profits.

The FOR is intended to calculate a minimum amount of capital that an investment firm would need to have available to absorb losses if it has cause to wind-down or exit the market.

To calculate relevant expenditure for the purposes of FOR, the investment firm first determines its total expenditure aer it has made any distribution of profits.

Basic liquid assets requirement

Under IFPR, all investment firms are to hold liquid assets equal to at least one-third of their FOR (plus, if relevant, 1.6% of the total amount of any guarantees provided to clients). This is based on meeting at least one month’s overheads.

The FCA expects firms to satisfy their basic liquid assets requirements using a specified list of “core liquid assets,” including (but not limited to) cash, units or shares in short-term regulated money market funds and short-term deposits at UK credit institutions. Such assets are expected to be held by (i.e. in the name of) the relevant FCA investment firm.

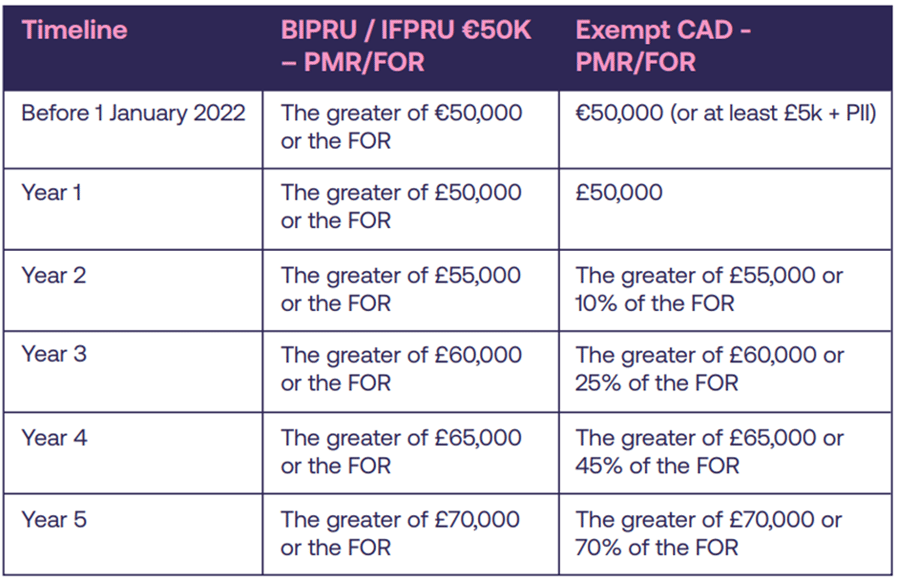

In its second IFPR policy statement, the FCA clarified that where a firm benefits from transitional relief limiting its FOR, it will also have its basic liquid assets requirement correspondingly reduced. For a former exempt CAD firm, this means the basic liquid assets requirement is equal to its transitional PMR in the first year, and 1/3 of the reduced FOR (10%) in year two.

(see next section for the transitional provisions).

Transitional arrangements

Transitional provisions (TPs) are available to help investment firms adjust to

the minimum capital requirements of the IFPR. The table below demonstrates how the base capital requirement increases gradually for firms that, after the commencement of IFPR, have a PMR of £75,000.

On 1 January 2027, five years aer MIFIDPRU began to apply, the transitional period will be over and the capital requirement, for SNI firms, will be the greater of the PMR of £75,000 and the FOR. Transitional provisions also apply to former BIPRU and IFPRU €50k Matched Principal firms and IFPRU €125k & €730k firms.

Note: There is no transitional relief with regard to the ICARA requirements, so in practice, firms may be required to hold capital in excess of that required under the transitional provisions.

Exempt CAD

The exempt CAD category disappears under the Investment Firms Prudential Regime IFPR and, if these firms plan to remain as MiFID firms, they will need to consider key issues including:

• Increase in capital requirements

• Need to calculate variable capital such as the FOR [and in some cases K-factors also]

• Whether they will be in a consolidation group

• Requirement to produce a risk-based capital assessment, known as an ICARA

• Being subject to the remuneration code for the first time

Former exempt CAD firms may well wish to review whether they need to remain a MiFID firm and, if not, whether they will be able to, or will wish to, opt out of MiFID via a Variation of Permission.

ICARA

All MiFID investment firms are required to establish an ICARA process. The ICARA process replaces the ICAAP that BIPRU and IFPRU firms were required to carry out and includes recovery planning and wind-down planning.

The IFPR introduced an overall financial adequacy rule (OFAR) designed to determine whether a firm has sufficient financial resources to fund its operations. Through the ICARA process, firms will determine what level of own funds and liquid assets they need over and above the own funds and basic liquid assets requirements outlined above.

The ICARA process is designed to allow a firm to identify, monitor, and, if relevant, mitigate all material potential harms that could result from a) ongoing operations or b) winding down of its business.

Frequency: A firm must review the adequacy of its ICARA process at least once every 12 months, and also following any material change in the firm’s business model or operating model.

The FCA confirmed that an investment firm group will not normally be required to operate an ICARA process on a consolidated basis, even if the group is subject to prudential consolidation under MIFIDPRU.

Remuneration

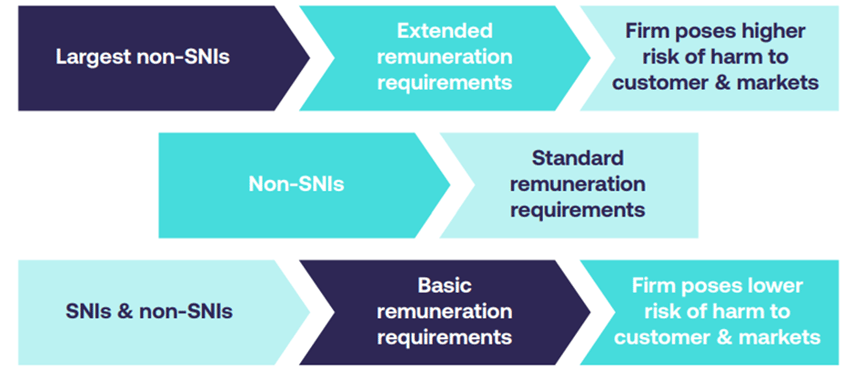

The FCA has removed the IFPRU and BIPRU Remuneration Codes and replaced them with Basic, Standard, and Extended remuneration requirements under the MIFIDPRU Remuneration Code.

Former exempt CAD firms are caught by a remuneration code for the first time. Basic remuneration requirements include:

• A remuneration policy to cover all staff

• Responsibility of the management body for overseeing its implementation

• Fixed and variable components of remuneration must be appropriately balanced

• Variable pay must not a ect the firm’s ability to ensure a sound capital base

Overview of application of remuneration requirements

Visit our ICARA & FCA Reporting services page for more information.

How can we help you?

Thistle Initiatives has supported firms for over 10 years as a trusted compliance and regulatory advisor. In addition to assisting you as and when our team of specialists can serve as your right hand in a meeting and complying with regulations. We understand the importance of staying up-to-date and compliant and are dedicated to providing the guidance and support needed to do so.

We’ve already supported hundreds of to understand, navigate implement the Investment Firms Prudential Regime (IFPR). Since the regime came into force in January 2022, we have been assisting firms with their ICARAs, which all MiFID investment firms are required to establish.

Thistle Initiatives can:

• Provide your firm with an ICARA template,

• Assist you in preparing your firm’s ICARA,

• Provide template policies, such as a Risk Management policy and Remuneration policy,

• Calculate your firms K-Factors

We continue to assist those firms with work still to do – or who simply want to verify they’ve got it right. Get in touch with us by calling 0207 436 0630 or sending an email to info@thistleinitiatives.co.uk.