Summary

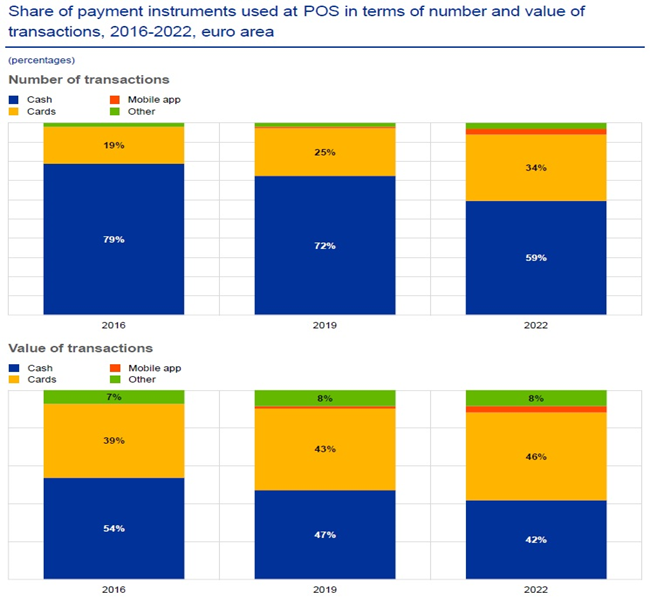

The European Central Bank (ECB) has published its latest study on consumer payment attitudes across the euro area. The report found that cash is still the most frequently used means of payment at point of sale (POS), but that its share is declining. Cash was used for 59% of POS transactions in 2022, down from 72% in 2019. It remains the most commonly used means of payment for small-value payments in stores and person-to-person transactions.

For the first time ever in 2022, payment cards’ share of POS transactions by value (46%) exceeded that of cash transactions (42%). In 2019, cash accounted for 47% of transactions by value and payment cards just 43%.

Consumers made payments using mobile phone apps more often in 2022, but mobile’s share of total POS payments was still relatively low in comparison with cash and cards. Mobile payments accounted for 3% of POS transactions in 2022, a threefold increase from 2019, and 4% by value (a 1% increase over the same period).

Research across all European markets suggests that eight in ten transactions at point of sale are now contactless. After coming from nowhere, contactless is expected to account for a third of UK transactions this year. By 2031, however, the report suggests, it will still only account for around half of UK credit card transactions and two-thirds of debit transactions.

https://www.ecb.europa.eu/stats/ecb_surveys/space/html/ecb.spacereport202212~783ffdf46e.en.html