Consolidated VCT sector sees investment boom

Update

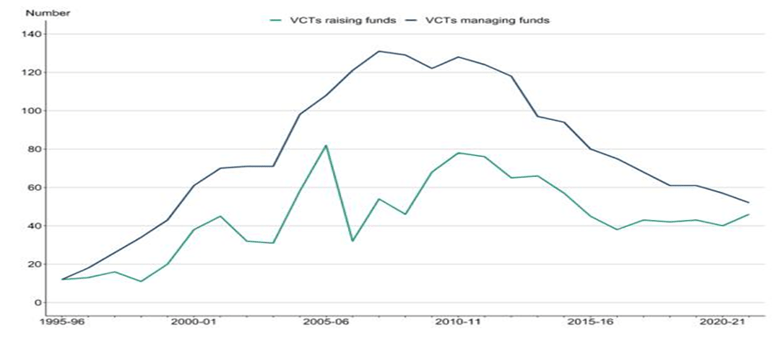

The venture capital trust sector underwent a consolidation last year while managing to increase its total fundraising by 68 percent. Figures released by HMRC [on] January 26 showed that 52 VCTs managed funds in the 2021/22 tax year, down from 57 the year before. However, there was a rise in the number of VCTs raising funds in the period, with six more in the market, taking the total to 46.

HMRC said the number of funds raised by VCTs and the number of VCTs raising money are normally closely linked, however in recent years, this been less evident.

“This trend has continued in 2021 to 2022, with a large increase in funds raised but a modest increase in the number of VCTs raising funds,” it said.

Nick Britton, head of intermediary communications for the Association of Investment Companies, said there are various reasons for this, with some VCTs merging together to save costs, while a number of limited-life VCTs have wound up. Due to a change in rules in 2015 and 2017, all VCT managers run 'evergreen' strategies, which have no set time period for being active.

Britton added: "Generally speaking these changes represent a tidying-up of the sector, leaving a smaller number of larger, more cost-effective VCTs. The diminishing number of VCTs also reflects the popularity of ‘top-up’ offers, where investors subscribe for shares in established VCTs, and the relative difficulty of launching completely new VCTs with no track record.”

Number of VCTs raising and managing funds, 1995-96 to 2021-22

Source: HMRC

The sector saw a boom in investment during the 2021/22 tax year, with £1.2bn invested, a rise of 68 percent on the year before.

Link: https://www.ftadviser.com/investments/2023/01/27/consolidated-vct-sector-sees-investment-boom