Consumer Confidence Boosted By £2.8bn Invested In Funds In April

Update

The Investment Association (IA) recently released its key findings for April 2023.

Key takeaways included the following:

- All asset classes saw inflows, with bond and money market funds each attracting £1bn

- Tracker funds experienced another strong month, with inflows of £6bn

- Equity funds saw a second consecutive month of inflows in 2023, with £93m

IA chief executive Chris Cummings said ‘April saw a surge in consumer confidence, with £2.8bn invested in funds, the highest level since August 2021. We have seen investors opt for a cautious approach favouring bond funds, which saw £.1.1bn inflows, and choosing globally diversified equity funds. UK gilts also benefited, with £259m invested in April. Demand for ISAs rose, with £342m invested within the tax-free wrapper, five times more than in the previous month. This was, however, less than the same time last year, with £646m invested in April 2022.’

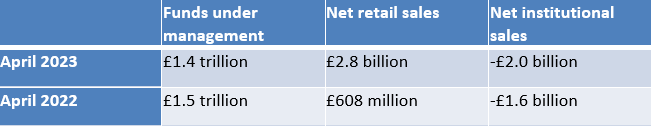

Funds under management and net sales

The five best-selling IA sectors for April 2023 were:

- Short Term Money Market, with net retail sales of £770m

- Global, with net retail sales of £340m

- UK Gilts, with net retail sales of £259m

- Specialist Bond, with net retail sales of £226m

Mixed Investment 40-85% Shares, with net retail sales of £225 million.

Link: https://www.theia.org/news/press-releases/april-sees-boost-consumer-confidence-ps28-billion-invested-funds