FCA Requires Personal Investment Firms To Hold Capital

What has happened?

In November 2023, the FCA announced in its Consultation Paper CP 23/24 proposals to require personal investment firms (PIFs) to set aside capital so that they can cover compensation costs and to ensure that “the polluter pays” when consumers are harmed by bad advice.

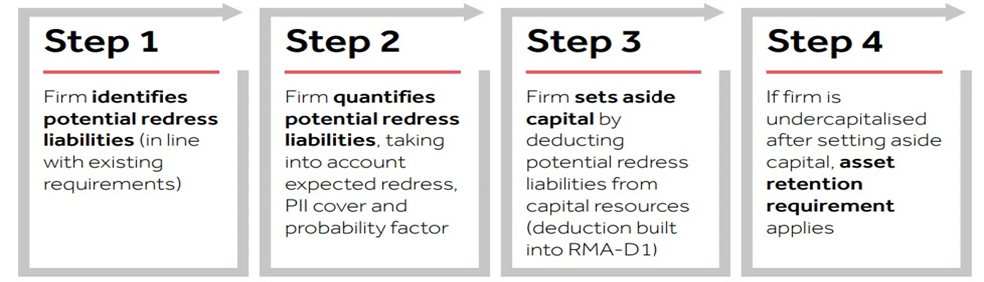

The proposals would require personal investment firms (often referred to as investment advisers) to calculate their potential redress liabilities at an early stage, to set aside enough capital to meet them and to report potential redress liabilities to the FCA. Any firm not holding enough capital will be subject to automatic asset retention rules to prevent it from disposing of its assets.

A related Dear CEO letter was issued to personal investment firms on the same day that the proposals were issued.

What are the points of the CP?

The FCA has emphasised that the Financial Services Compensation Scheme paid out nearly £760m between 2016 and 2022 for poor advice provided by failed personal investment firms, and that 95% of this was generated by 75 firms.

The proposals now seek to ensure that the “polluter” pays for the redress costs generated. It will be those firms that provide bad advice who will be responsible for setting aside enough capital to compensate for it. In turn, the proposals are intended to create a significant incentive for firms to provide good advice in the first place and to right wrongs quickly. Graphically, the intended process is depicted in the CP as follows;

The proposals are designed to be proportionate and to build on existing capital requirements. The measures would exclude around 500 sole traders and unlimited partnerships from the automatic asset retention requirements. Firms that are part of prudentially supervised groups, which assess risk on a group-wide basis, would also be excluded from them.

The FCA is keen to hear what industry and other stakeholders think of these proposals, and recognising the importance of getting this step right, it is extending its consultation period to 16 weeks.

The FCA expects to publish the next steps in the joint review of the Advice Guidance Boundary, which it is conducting alongside the Government in the coming weeks. Read here for further details of this.

The FCA is planning an extensive programme of outreach to the industry and consumer groups as part of the consultation, which runs until 20 March 2024. The FCA will aim to publish a Policy Statement in H2 2024 and it expects rules to come into force in the first half of 2025.

The Dear CEO letter issued emphasised the following points;

Firms’ ongoing responsibilities

- Firms should continue to handle complaints in accordance with DISP. The FCA will consider acting if it finds that firms are taking steps that might deter their customers from pursuing a complaint or referring a complaint to the Financial Ombudsman Service.

- Firms should continue to assess their financial resources against the risk of harm and the complexity of their business.

- Firms must not seek to avoid potential redress liabilities. This could include actions such as changing their corporate structure to isolate liabilities and protect assets (including selling or transferring the client bank), overpaying dividends or allowing the firm to run into an insolvent position.

- The FCA expects firms to notify it immediately on becoming aware, or when they have information which reasonably suggests, that any of the following has or may have happened, or may happen in the future:

- the firm does not have adequate resources to provide potential redress,

- the firm intends to sell or transfer its client bank, and the sale could have an impact on the firm’s risk profile, value or resources, and/or

- the firm has potential redress liabilities and wants to offer consumers less redress than they might be due.

Authorisations and cancellations during the consultation period

- During the consultation period, the FCA will be carrying out increased monitoring of firms applying to cancel or seeking to apply for new authorisations. This is to prevent firms and individuals from attempting to avoid potential redress liabilities or otherwise trying to phoenix.

How can we help you with FCA compliance?

Thistle Initiatives has supported personal investment firms for over 10 years as a trusted compliance and regulatory advisor. In addition to assisting you as-and-when, our team of specialists can serve as your right hand in meeting and complying with FCA regulations. We understand the importance of staying up-to-date and compliant and are dedicated to providing the guidance and support needed to do so.

Are you looking for help with your capital adequacy assessment or redress calculations, or more general regulatory questions? Contact our specialist team now to schedule a free consultation. Get in touch with us by calling 020 7436 0630 or sending an email to info@thistleinitiatives.co.uk.