Summary of Development

Mobile money is now considered a mainstream financial service in many countries During the COVID-19 pandemic, mobile money enabled millions of people in low- and middle income countries (LMICs) to access digital financial services (DFS) for their daily needs.

As the impact of the pandemic eased, mobile money services grew faster in 2022 than during pre-COVID times. The habit of using digital payments, enforced by the pandemic, has stuck for many.

In many countries, growth in mobile money (MM) activity is now outpacing new registrations – a sign that the industry is maturing beyond a handful of markets – this is according to the latest annual State of the Industry Report on Mobile Money by the GSMA.

The pandemic itself led to a significant global expansion of mobile money services and accounts. Data from the annual GSMA Global Adoption Survey suggests that registered accounts and 30-day active accounts grew faster than forecast in 2019. The pandemic was partly responsible for an additional 400 million registered accounts between 2019 and 2022. This is at least 30% higher than forecast in 2019. Pandemic lockdowns and restrictions on movement drove up the use of digital payments, including mobile money, globally.

The State of the Industry Report 2023 looks at the growth of mobile money in a post-pandemic world. The report highlights what this has meant for mobile money providers (MMPs), agent networks and the millions of new and existing customers that embraced mobile money in 2022.

Adoption and active usage continue to rise

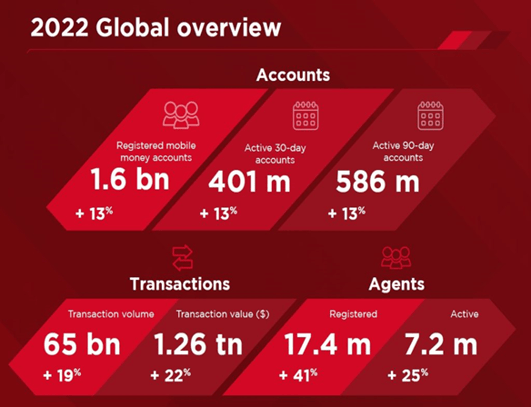

Registered accounts grew by 13% year on year, from 1.4 billion in 2021 to 1.6 billion in 2022. This can be attributed, in part, to regulatory changes in Sub-Saharan Africa, particularly in Nigeria and Ethiopia where mobile money adoption rose rapidly.

Links:https://www.paymentscardsandmobile.com/state-of-the-industry-report-on-mobile-money-2/