Update

Uncertain market conditions and increased correlation between asset classes have more investors considering absolute return funds as a solution, despite no AR fund providing returns in all market conditions since Brexit.

According to a survey commissioned by Fulcrum Asset Management - which runs several absolute return products - investors were "inclined to consider absolute return funds as part of their overall asset allocation" because of ongoing market volatility. It found that seven in 10 institutional investors were considering allocating to absolute return.

CIO of Fulcrum Nabeel Abdoula said he was "not surprised" at the recent interest in absolute return given how "poorly traditional asset classes were performing", however, he recognised that there were still some "negative perceptions about the asset class".

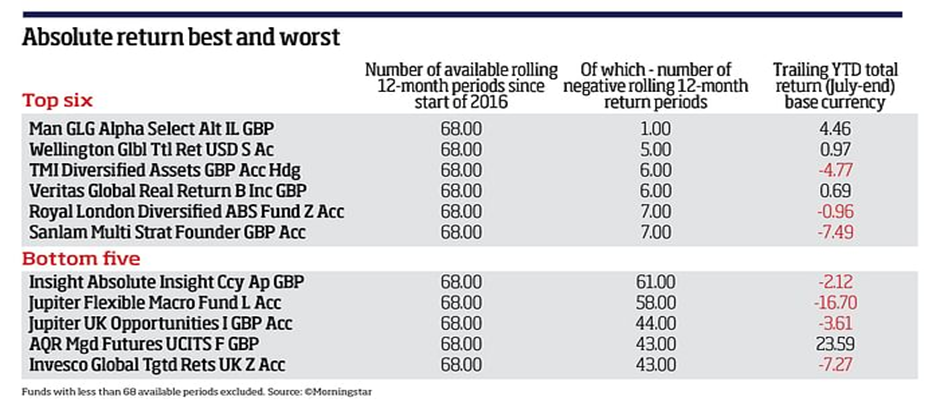

AR funds continue to suffer from a poor reputation, largely linked to the fact no IA Targeted Absolute Return fund has delivered consistent, positive rolling returns since the start of 2016. According to data from Morningstar, only 56 out of 108 IA Targeted Absolute Return funds have achieved at least 50% positive periods on a rolling basis since the beginning of 2016. This was based on the funds with data for that entire time frame or 68 rolling periods.

The same data revealed that of all AR funds that had 68 rolling periods of performance, only ten funds had fewer than ten periods of negative returns.

Man GLG Alpha Select came the closest to its rolling returns goal, with only one negative period during the set timeframe.

In its study, Fulcrum even found that despite investors being more open to adding AR to their portfolios they were split on the quality of the asset class. Just 35% of those surveyed were "broadly positive" on the sector, while 34% said they were "broadly negative". The remaining 30% said they were "unsure".