Summary

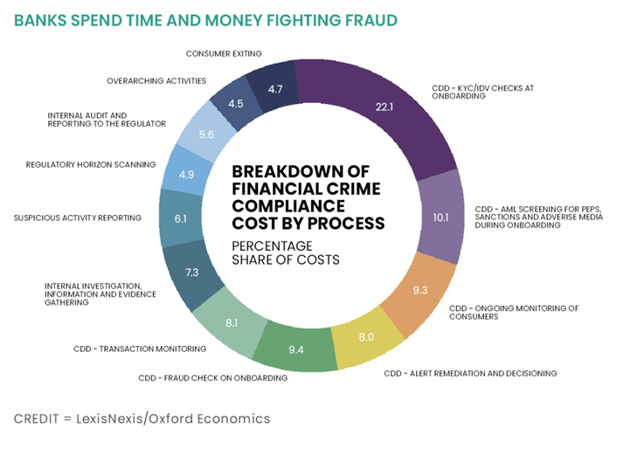

We have recently seen a slew of bad news about an alarming ongoing rise in payments fraud, especially in the online environment. According to LexisNexis Risk Solutions and Oxford Economics, UK financial services firms are spending the equivalent of two-thirds of the country’s defence budget (£34.2bn) on fraud defences.

PwC reports that 52% of companies with global annual revenues over $10bn experienced fraud during the past 24 months, with almost one in five saying their most disruptive incident cost more than $50m. New data from SonicWall helps quantify the scale of the problem, revealing that online attacks against financial institutions more than trebled last year.

Malware, ransomware and intrusive attacks were all up sharply, with so-called crypto-jacking (hijacking user accounts and stealing cryptocurrencies) and attacks targeting inter-app transactions trebling and doubling respectively. SonicWall reports that two-thirds of firms are aware of the problems, but more vulnerabilities are being revealed year after year.

While the rate of losses remains low, it is growing in line with the digitalisation of the global economy, i.e. by between 17 and 23% per year, depending on which estimate you take. Countermeasures could include designing less vulnerable software, employing better data analytics to identify fraud in real time, and introducing either private, or ‘sovereign' digital ID, or government ID schemes. However we do it, it’s time to take action against online fraud.

Links: https://www.paymentscardsandmobile.com/the-fraud-epidemic-isnt-going-away-lets-act/