World Payments Report Finds Non-cash Transactions Are Rising

Summary

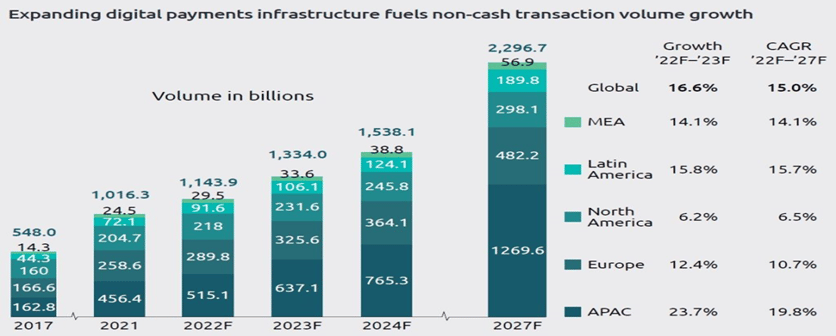

Non-cash transaction volumes have maintained their upward momentum, as consumers and businesses adopt digital payment schemes. The World Payments Report 2023 estimates that non-cash transaction volume growth will continue accelerating over the period from 2022 to 2027 at a CAGR of 15%, as the digital payments infrastructure expands and new payment instruments proliferate.

Non-cash volumes are predicted to achieve a compound annual growth rate of 10.7% between 2022 and 2027, fuelled by the expansion of instant payments, Open Banking regulatory (PSD3) enhancements, and the EU’s Digital Identity Wallet 2023 pilot initiative.

Eurosystem launched the Target Instant Payment Settlement System (TIPS) in November 2018, but its initial reception was tepid, with Single Euro Payments Area instant credit transfers (SCT Inst) accounting for just 14% of all SEPA credit transfers during H1 2023.

The European Union proposed amendments to the 2012 SEPA regulation in 2022 to eliminate adoption barriers and streamline instant payment (IP) system use. The European Payment Initiative (EPI) is also piloting an IP scheme in 2023 after acquiring iDeal and Belgium-based Payconiq. The EPI pilot will include digital wallets and an Open Banking instant payment system in Germany and France.