Asset Migration Service

Increased competition in the platform sector and IFA consolidation saw 34% of advisers migrate assets between platforms in 2023.

Many advisers are put off by the effort and disruption involved in switching providers despite their clients, in a new Consumer Duty world, receiving a better outcome by moving and in some instances, helping to avoid foreseeable harm. Also, less time wrestling with a poorly performing platform means more time delivering valuable financial advice and financial planning service.

To resolve this, narrow data migration services are beginning to appear, however, none offer an independent end-to-end and compliant solution that successfully addresses suitability requirements and communications, whilst reducing migration timescales, client disturbance and adviser effort.

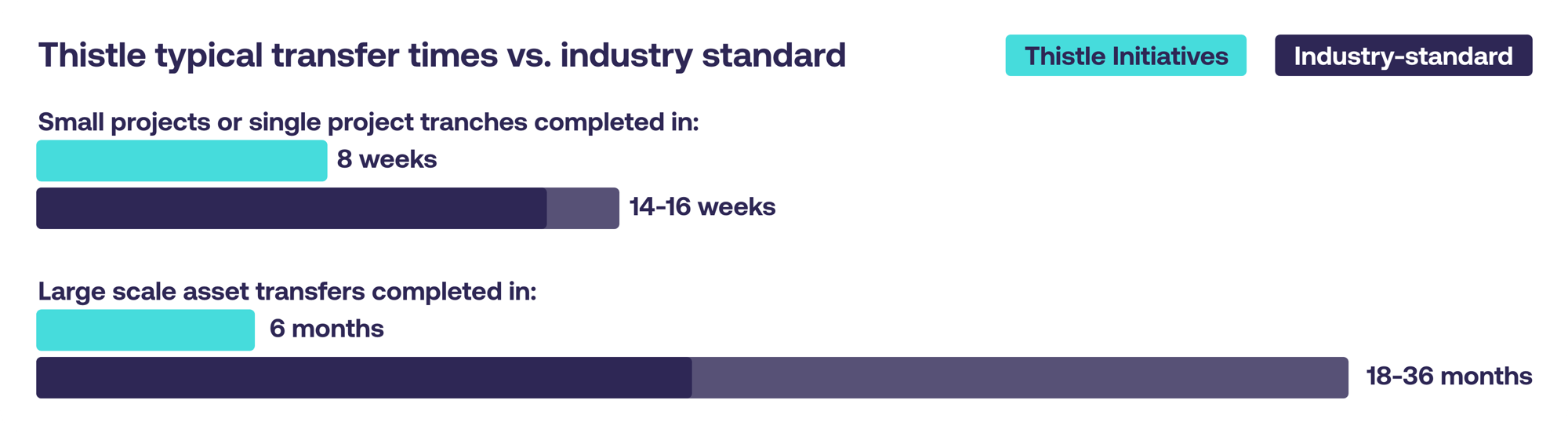

Our experience in this sector, through ex-platform CTO, COO and CROs, draws upon decades of technology and compliance knowledge. As a result, we have developed a unique data discovery, analysis and migration design tool, wrapped around a suite of compliance and project management services. Ultimately, this moves assets in a repeatable, predictable way in unprecedented timescales.

Increased competition in the platform sector and IFA consolidation saw 34% of advisers migrate assets between platforms in 2023.

Many advisers are put off by the effort and disruption involved in switching providers despite their clients, in a new Consumer Duty world, receiving a better outcome by moving and in some instances, helping to avoid foreseeable harm. Also, less time wrestling with a poorly performing platform means more time delivering valuable financial advice and financial planning service.

To resolve this, narrow data migration services are beginning to appear, however, none offer an independent end-to-end and compliant solution that successfully addresses suitability requirements and communications, whilst reducing migration timescales, client disturbance and adviser effort.

Our experience in this sector, through ex-platform CTO, COO and CROs, draws upon decades of technology and compliance knowledge. As a result, we have developed a unique data discovery, analysis and migration design tool, wrapped around a suite of compliance and project management services. Ultimately, this moves assets in a repeatable, predictable way in unprecedented timescales.

What we offer

- Revenue Protection: Safeguards advice charge revenue during asset transit.

- Accelerated Earnings: Moves assets to the target platform quicker, bringing platform savings or revenue sooner.

- Cost Savings: Eliminates the need for temporary internal teams – we handle everything end-to-end.

- Error-Free Operations: Tailored playbooks and automated workflows minimise manual errors and inefficiencies.

The Asset Migration Lifecyle

Our Asset Migration Service is modular. Each part of the service can be operated individually or as part of a comprehensive packaged service. It can also be easily adapted to your platform of choice.

%20%20-%20%20Read-Only.png?width=2000&height=875&name=Thistle%20Asset%20Migration%20Service%20(002)%20%20-%20%20Read-Only.png)

Asset Migration Service

We work closely with advice firms to understand their business, data structures and above all, their clients. Our migration tool utilises unique batching logic that extracts and computes data from varying sources enabling a firm to understand the clients that can be migrated quickly and efficiently to their platform of choice (known as client ‘cohorts’). Every identified client cohort has its own switch playbook, each with its own set of actions and considerations.

Once the migration approach is agreed, we provide a full project plan and resource proposal, while the tool batches clients and provides the data to the target platform to create accounts and generate client disclosures.

Our supporting compliance and project management services, utilise our acquired knowledge of the industry to understand the underlying capability of the providers involved in the exercise, together with regulatory obligations and best practice. All designed to make the process faster.

This typically results in an 8-week migration project, that covers client communications, data validation and physical movement, ultimately ensuring the advice firm and their client’s best interests are protected throughout.

Features & Benefits

Automated Tool

- Data Extraction: Generates and computes qualitative and quantitative data from Back Office systems.

- Data Augmentation: Data mapping and lookup to provide pricing comparison and value premium assessments.

- Automated Cohorting: Generation of client groups using our unique batching logic.

- Error Prevention: Enhancement and validation of data to minimise transfers rejections.

- Transfer Initiation: Triggering of client batches to provide control, assurance and smooth transfer.

- Inflight View: Real-time monitoring of client and asset progress from initiation to completion.

Exceptional Service

- Compliant Communications: We ensure all communications are fully compliant and your client’s best interests are protected.

- Data Security: We process only essential data at each stage, with secure handling and erasure protocols.

- Customised Plans: We partner with advice firms to design fully thought through and bespoke project plans.

- Your Representative: We act as you and your clients trusted guardian managing all cede and target platform interactions.

- Quick Resolution: We address exceptions rapidly and remove blockers forcing engagement with third-party providers.

- Comprehensive Service: We consider all elements of a platform switch including investment strategies and rebalancing.

Contact our experts

As a Partner in the Investments team at Thistle Initiatives, Tom focuses on the Wealth sector, bringing a unique perspective from his experience in launching and managing regulated fintech businesses. As a former Chief Risk Officer (SMF4), Tom has a strong focus on strategic execution, including product launches, asset migrations, and business management. His areas of expertise include Prudential standards, CASS, Information Security, Operational Resilience, and Consumer Duty.

Dave has been at the forefront of the platform industry since its inception, forming and launching the Selestia platform in the early 2000s. Since then, Dave has formed and led several consulting businesses, building a track record in platform implementation, migration, operational optimisation, integration, and customer experience design and delivery. Dave is renowned for his development of analytical tools and change frameworks that provide a data-centric approach to service optimisation. As a SAFe Practice Consultant, he has in-depth experience in Agile software delivery and adapting IT practices for businesses seeking to transform digital service delivery and drive increased profitability.