Managed Services

Increased competition in the platform sector and IFA consolidation saw 34% of advisers migrate assets between platforms in 2023.

Many advisers are put off by the effort and disruption involved in switching providers despite their clients, in a new Consumer Duty world, receiving a better outcome by moving and in some instances, helping to avoid foreseeable harm. Also, less time wrestling with a poorly performing platform means more time delivering valuable financial advice and financial planning service.

To resolve this, narrow data migration services are beginning to appear, however, none offer an independent end-to-end and compliant solution that successfully addresses suitability requirements and communications, whilst reducing migration timescales, client disturbance and adviser effort.

Our experience in this sector, through ex-platform CTO, COO and CROs, draws upon decades of technology and compliance knowledge. As a result, we have developed a unique data discovery, analysis and migration design tool, wrapped around a suite of compliance and project management services. Ultimately, this moves assets in a repeatable, predictable way in unprecedented timescales.

We address critical resource needs with proven expertise and fast deployment of expert teams. We deployed a team of 15 analysts in one business days and cleared 20,000+ sanctions and PEP cases in less than three weeks.

In today's fast-evolving regulatory landscape, financial institutions must stay ahead of compliance challenges while maintaining seamless operations.

At Thistle Initiatives, our Managed Services solution provides immediate access to expert teams, strategic project delivery, and tailored remediation solutions, ensuring your firm meets and exceeds regulatory expectations without disrupting daily business operations and BAU.

Our team of specialists has extensive experience in financial crime operations. We specialise in various areas, including KYC, KYB, CDD, and EDD reviews, AML investigations, TM and KYT investigations, customer screening, sanctions and payment screening.

Our experts are ready to be deployed quickly, offering the agility and expertise required to remediate issues efficiently.

Whether you're facing an FCA review, tackling compliance backlogs, or strengthening governance frameworks, our flexible resource augmentation ensures you have the right skills exactly where and when you need them the most.

What we offer

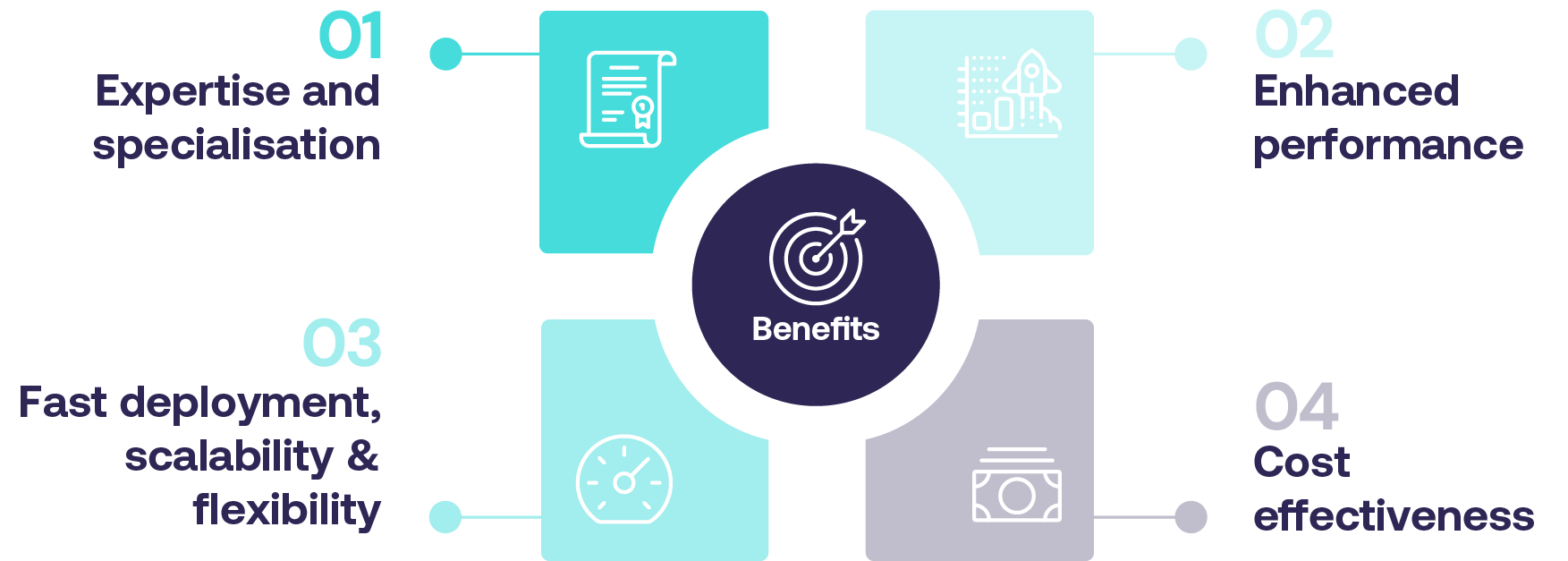

Expertise and specialisation

- Access to industry experts: our team of professionals understand the intricacies and nuances of financial crime compliance.

- Access to tools and software: our teams have experience in using a variety of tools and systems.

- Access to industry best practices: our teams stay up-to-date with the latest financial crime trends and regulatory updates.

Fast deployment, scalability and flexibility

- Fast sourcing, vetting and mobilisation: our resources are readily available. We deployed 15+ resources in two business days.

- Flexible pool of experts: We can scale up and down quickly, with teams adapting to specific organisational needs.

- Immediate access to various roles and seniorities: including Analysts, Investigators, Team Leads and Quality Control Checkers

Cost effectiveness

- Reduced operational costs: no need to recruit, hire or train in-house staff.

- Predictable costs: organisations only pay for what they need.

- Improved resource allocation: our teams can be assigned to complex projects or can augment teams for BAU support.

Enhanced performance

- Stronger compliance: our teams ensure adherence to local and international laws and regulatory requirements.

- Proactive threat detection: our experts can effectively identify, escalate, and prevent financial crime risks.

- Reputational safeguarding: our teams proactively safeguard your reputation by solving issues and mitigating risks.

- Seamless integration: our teams integrate seamlessly into existing structures to enhance efficiency and output.

Your partner for expert Financial Crime Transformation

- Large UK-based Investment Platform

- Managed Services Support

- Thistle provided 15 resources in one business day

- The Firm has cleared the existing backlog

The Challenge

The client implemented a new screening tool experienced a sudden increase in alerts, resulting in a backlog of over 20,000 cases for review within a tight deadline. Facing regulatory scrutiny, the client needed to clear the backlog quickly and re-test the screening tool.

The Solution

Thistle provided a team of 15 experienced professionals within one business day. After a one-day training session, the Thistle team began working on alerts and successfully cleared the entire backlog in less than three weeks.

Thistle also supplied a senior team leader who managed all interactions with key stakeholders and provided accurate updates on a daily basis. The Thistle team worked overtime and on weekends at no extra cost to expedite the review process.

As a result, the client retained two resources to work full-time alongside their core team in order to manage business-as-usual (BAU) volumes and prevent the backlog from reoccurring.

The Result

Thistle successfully reviewed and cleared the entire backlog in a timely manner while assisting the client in managing communications with their own clients. The team collaborated closely with the core team and IT to identify and address the root causes of the backlog. Currently, two resources are supporting the client with BAU operations.

- Non-Bank Financial Institution

- The remediation successfully implemented a new Customer Risk Assessment

- The Firm is compliant with regulatory requirements

The Challenge

The client, a non-bank financial entity, aimed to enhance their Know Your Customer (KYC) standards by rolling out a new Customer Risk Assessment methodology. The Firm had to apply this new methodology to the back-book of customers (all complex corporate structures).

The Solution

Thistle have provided the client with one expert KYC resource to augment their core team. Thistle’s resource conducted a comprehensive gap analysis of client files that lacked adequate risk assessments. This involved identifying key deficiencies and addressing them through targeted actions, including:

-

Gathering and verifying missing documentation (for example, identification requirements)

-

Conducting outreach and engaging in calls with relevant stakeholders to resolve outstanding information requests

-

Utilising a customer risk assessment tool to appropriately assess and risk rate client files.

Given the knowledge and expertise of the Thistle resource, the individual was responsible for remediating the high-risk, complex client files. These efforts resulted in significant progress in ensuring compliance with regulatory requirements and standards across their client files.

The Result

Our work led to substantial improvements for the client, effectively addressing the key deficiencies identified and filling in compliance gaps. All gaps were cleared and the new Customer Risk Assessment methodology applied. .

Contact our expert

Ilaria has a deep understanding of Financial Crime Compliance and has offered valuable support to various organisations, including Tier 1 Banks across the UK, EU, and internationally.

Her expertise includes conducting Quality Control assessments to identify areas for enhancement and overseeing FCC programs to devise strategies for implementing robust internal controls. Experienced in leading diverse teams, both onshore and offshore, Ilaria has managed large-scale, complex projects across multiple jurisdictions, ensuring seamless execution and regulatory adherence.

Prior to Thistle, she gained significant experience at various consultancy firms, including a Big4 firm, and contributed to the global monitorship involving HSBC. Ilaria holds an L.L.M and L.L.B in Law.